riverside county sales tax

The current total local sales tax rate in Riverside IL is 10000. The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures.

Riverside California Sales Tax Rate 2021 The 875 sales tax rate in Riverside consists of 6 California state sales tax 025 Riverside County sales tax 1 Riverside tax.

. 075 lower than the maximum sales tax in CA The 875 sales tax rate in Riverside consists of 6 California state sales tax 025 Riverside County sales tax 1 Riverside tax and 15. The December 2020 total local sales tax rate was also 8750. The California state sales tax rate is currently.

The minimum combined 2022 sales tax rate for Riverside County California is. This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 7750.

Riverside County Assessor-County Clerk-Recorder Office Hours Locations Phone. The riverside sales tax rate is. A full list of.

A county-wide sales tax rate of 025 is applicable. The current total local sales tax rate in Riverside CA is 8750. The December 2020 total local sales tax rate was also 6600.

951 955-6200 Live Agents from 8 am - 5 pm M-F Click Here to Contact Us. The current total local sales tax rate in Riverside County CA is 7750. This is the total of state and county sales tax rates.

Welcome to the Riverside County Property Tax Portal The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce. 53 rows The Riverside County Sales Tax is 025. The current total local sales tax rate in Riverside MO is 6600.

The California sales tax rate is currently. Regular Property Tax Bills Information and the link to the Riverside County Treasurer-Tax Collectors office. Sales Tax Breakdown Riverside Details Riverside.

832 Average Sales Tax Summary Riverside County is located in California and contains around 43 cities towns and other locations. The Riverside California sales tax is 875 consisting of 600 California state sales. As for zip codes there are around 97 of them.

Special Assessments Information about special assessments and other fees. 6 rows The Riverside County California sales tax is 775 consisting of 600 California state. My staff and I are dedicated to improving your online experience to better help you find the information youre looking for such as paying.

The December 2020 total local sales tax rate was also 10000. The minimum combined 2022 sales tax rate for Riverside California is. The one with the highest sales tax rate is 92262 and the one with the lowest sales tax rate is 91752.

Tax Sale Information Secured - The purpose of a Secured tax sale is to return tax defaulted property back to the tax roll collect unpaid taxes and convey title to the purchaser. Message from Matt JenningsTreasurer-Tax Collector.

Riverside County Office Of Economic Development

Avalara For B2c Commerce Avalara Appexchange

Riverside County Transportation Commission Rctc California Association Of Councils Of Governments

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

8 8 Billion Riverside County Sales Tax Takes Step Toward November 2020 Ballot Press Enterprise

These Riverside County Freeways And Roads Could Benefit From An 8 8 Billion Sales Tax Press Enterprise

Riverside County Planning Department Frequently Asked Questions

Job Opportunities Sorted By Job Title Ascending Career Opportunities

Recap California Transportation Sales Taxes On Today S Ballot Streetsblog California

Office Of The Treasurer Tax Collector Understanding Your Tax Bill

Finance And Government Services County Of Riverside

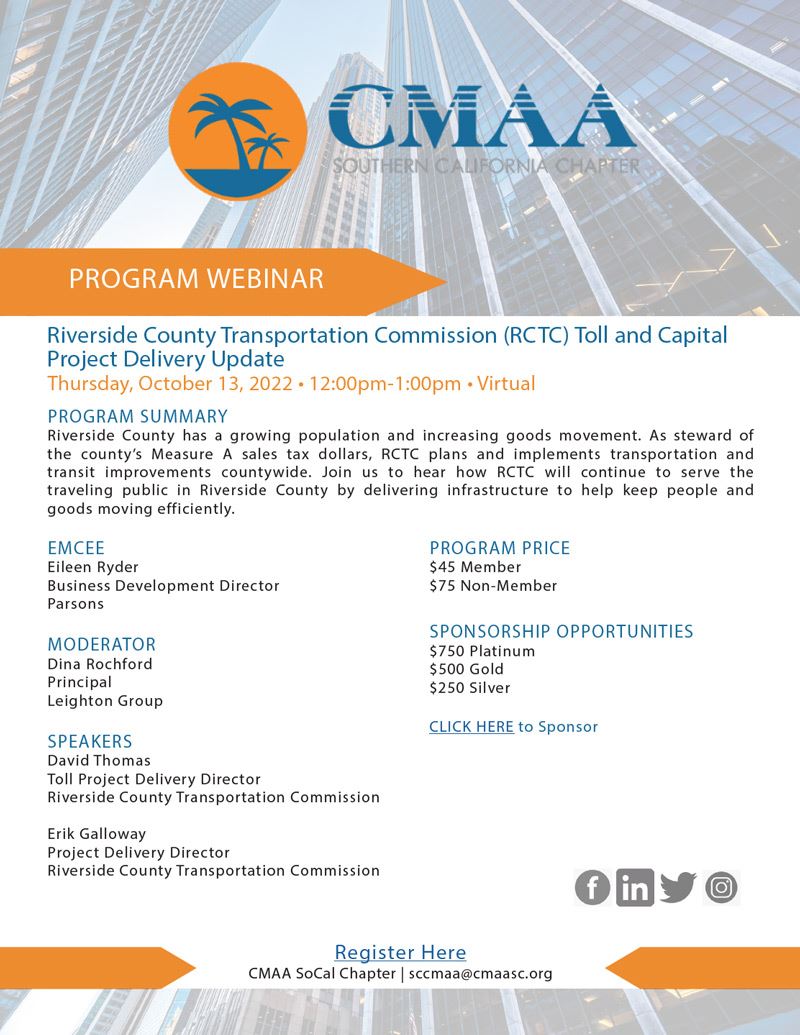

Cmaa Socal Chapter Riverside County Transportation Commission Rctc Toll And Capital Project Delivery Update

Property Tax Calculator Estimator For Real Estate And Homes

Data Distribution Riverside County Geographic Information Systems Gis

Taxation In California Wikipedia